Press release

December 17, 2020

At the conference of the USAID Factoring Project implemented by Factor Trust, key experts presented the project highlights and provided a guide for Macedonian companies interested in using factoring or supply chain factoring, as an alternative financial instrument.

The project successfully completed its goal of accelerating the growth of small-and-medium sized companies through facilitating the use of alternative access to finance. It has also significantly increased the number of financial institutions offering factoring, and has generated an overall factoring portfolio from 7 million Euro in 2017 to more than 40 million Euro in 2020.

“Over the course of the project, from 2017 – 2020, we have signed more than 300 contracts with SMEs, and have assisted around 150 businesses in obtaining finance in a value of $3.5 million. In order to increase the market awareness of alternative financial instruments, we have organized more than 50 events and workshops with key stakeholders.” – stated Lovre Ristevski, chief of mission of the USAID Factoring project.

The presentation highlighted the benefits of factoring and reverse factoring and indicated that there is a considerably high level of interest for these instruments, especially on the demand side. “It is evident that the Macedonian market has the potential for high levels of growth, especially with the use of supply chain finance instruments. Education and greater awareness of the field of SCF and its instruments within the banking and business sector are hence crucial in fostering market growth in the Macedonian economy. – stated Biljana Markovic Stamenova, Stankovic, Co-founder and Managing Partner at PrimePoint Partners.

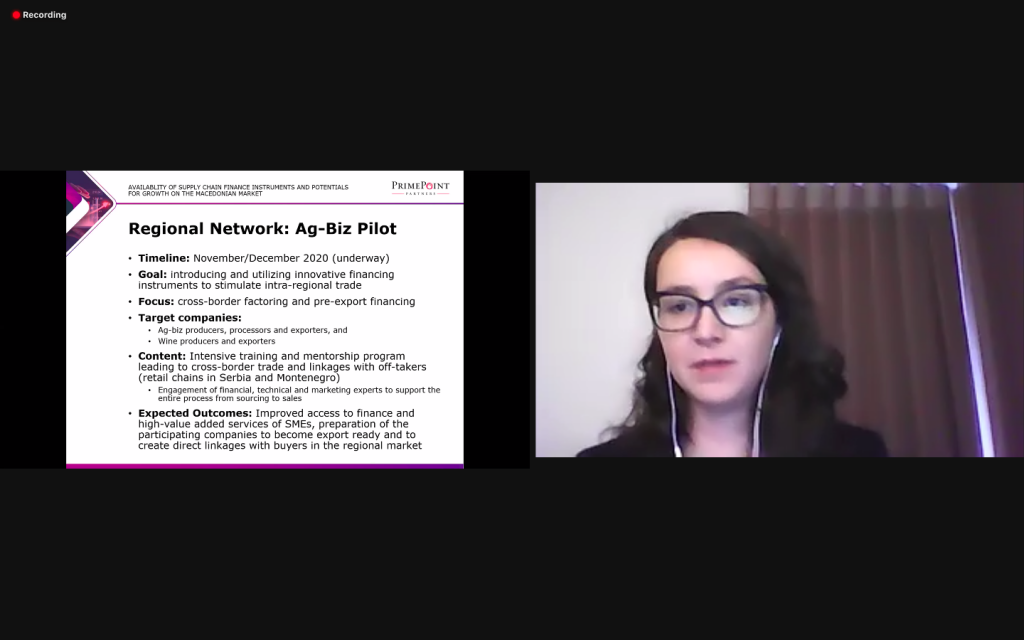

As one of its final activities, the Factoring Project is working on a Regional Agri-biz Digital Acceleration Program,which connects Macedonian producers with regional off-takers by offering them technical assistance for cross-border trade. Implemented by consulting company, PrimePoint Partners, the Regional Agri-biz Digital Acceleration Program is focused on utilizing innovative financing instruments to stimulate international trade, such as cross-border factoring and pre-export financing.